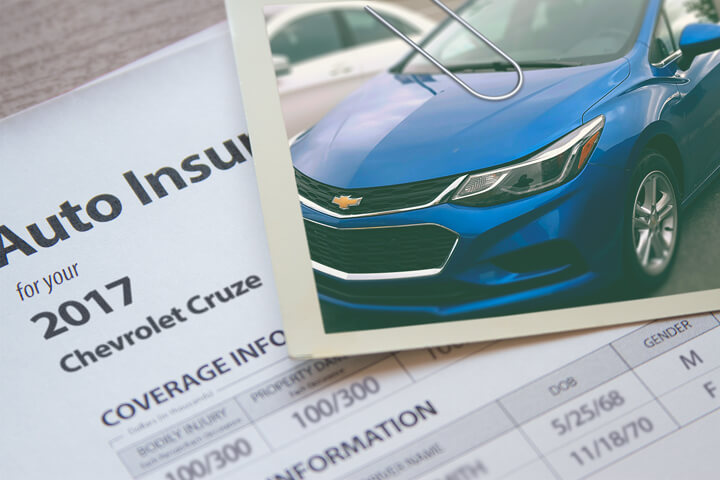

Chevy Cruze insurance policy image courtesy of QuoteInspector.com

If you want to save money, the best way to get low-cost Chevy Cruze insurance in Columbus is to compare quotes annually from insurance carriers who sell auto insurance in Ohio.

If you want to save money, the best way to get low-cost Chevy Cruze insurance in Columbus is to compare quotes annually from insurance carriers who sell auto insurance in Ohio.

- It will benefit you to learn about the different coverages in a policy and the changes you can make to keep rates in check. Many policy risk factors that are responsible for high rates like inattentive driving and an imperfect credit rating can be eliminated by improving your driving habits or financial responsibility.

- Compare rates from independent agents, exclusive agents, and direct companies. Direct companies and exclusive agencies can only provide price estimates from one company like Progressive and State Farm, while independent agents can quote rates for a wide range of companies.

- Compare the price quotes to your existing rates and see if there is a cheaper rate. If you can save some money and make a switch, make sure there is no coverage gap between policies.

- Provide written notification to your current company of your intention to cancel your current policy. Submit the completed application along with a down payment for your new policy. As soon as coverage is bound, put the certificate verifying proof of insurance in your glove compartment.

The most important part of shopping around is to make sure you enter identical coverage information on every quote request and and to get quotes from all possible companies. This helps ensure an apples-to-apples comparison and a complete selection of prices.

It's an obvious statement that insurance companies don't want their customers to go rate shopping. Consumers who shop for lower rates are likely to switch insurance companies because of the high probability of finding good coverage at a lower price. A survey found that consumers who regularly shopped around saved as much as $865 annually as compared to drivers who don't make a habit of comparing rates.

If finding the cheapest price for auto insurance is your target objective, then knowing the best ways to find and compare insurance rates can save time and money.

If you're already insured or just want cheaper rates, you can follow these tips to get lower rates and still have adequate protection. Choosing the best rates in Columbus is quite easy if you know the best way to do it. Drivers just need to learn the quickest way to compare rate quotes over the internet.

The fastest way that we advise to get rate comparisons for Chevy Cruze insurance in Columbus takes advantage of the fact auto insurance companies have advanced systems to compare their rates. All you need to do is provide information like your job, if a SR-22 is required, whether you are married, and whether your vehicle is owned or leased. That information is submitted instantly to many different companies and you receive quotes immediately.

To get price quotes for your car now, click here and find out if lower rates are available in Columbus.

The companies shown below offer quotes in Ohio. If multiple companies are listed, we recommend you get rates from several of them to find the most competitive car insurance rates.

Auto insurance discounts help lower rates for Chevy Cruze insurance in Columbus

Companies offering auto insurance don't always advertise all discounts very clearly, so below is a list both the well known as well as the least known discounts you could be receiving when you buy Columbus auto insurance online. If you check and find you aren't receiving every discount you deserve, you may be paying too high a price.

- Multiple Vehicles - Having all your vehicles on one policy can reduce rates for all insured vehicles.

- Online Discount - Certain auto insurance companies will discount your bill up to fifty bucks for buying your policy online.

- Senior Citizens - Drivers that qualify as senior citizens may be able to get a slight reduction on a Columbus auto insurance quote.

- Military Discounts - Being deployed with a military unit may lower your rates slightly.

- Homeowners Savings - Owning your own home or condo may trigger a policy discount on auto insurance since owning and maintaining a home is proof of financial responsibility.

- Use Seat Belts - Drivers who always wear seat belts and also require passengers to buckle their seat belts can save 10% or more off the PIP or medical payment premium.

- Early Signing - A few insurance companies offer discounts for buying a policy early. This can save 10% or more.

Discounts save money, but please remember that most credits do not apply to all coverage premiums. The majority will only reduce the cost of specific coverages such as comp or med pay. So even though you would think you would end up receiving a 100% discount, auto insurance companies aren't that generous.

To find providers who offer free Chevy Cruze insurance quotes in Ohio, click here.

Three reasons to not skimp on insurance

Despite the high cost, insurance is required in Ohio but it also protects you in many ways.

- The majority of states have mandatory liability insurance requirements which means you are required to carry specific limits of liability insurance in order to drive the car legally. In Ohio these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If your Chevy Cruze has a lienholder, most banks will make it mandatory that you have comprehensive coverage to guarantee payment of the loan. If you let the policy lapse, the bank will be required to insure your Chevy at a significantly higher premium and require you to reimburse them for it.

- Insurance preserves not only your vehicle but also your financial assets. Insurance will also pay for medical transport and hospital expenses incurred in an accident. Liability coverage, the one required by state law, will also pay for a defense attorney in the event you are sued. If your car is damaged in a storm or accident, comprehensive and/or collision insurance will pay to repair the damage minus the deductible amount.

The benefits of insuring your Cruze more than offset the price you pay, especially if you ever need it. The average driver in Ohio is wasting up to $869 every year so shop around each time the policy renews to save money.

What is the best auto insurance coverage?

When choosing coverage, there is no cookie cutter policy. Everyone's needs are different.

Here are some questions about coverages that may help highlight whether you would benefit from professional advice.

- Do I need added coverage for expensive stereo equipment?

- Does medical payments coverage apply to all occupants?

- What is the difference between comprehensive and collision coverage?

- Where can I find high-risk insurance?

- What is no-fault insurance?

- What is medical payments coverage?

- Can I cancel at any time?

- What is glass protection for?

- What is roadside assistance coverage?

If it's difficult to answer those questions, you might consider talking to an insurance agent. To find an agent in your area, complete this form. It is quick, free and you can get the answers you need.

When to talk to an agent

Many people still prefer to sit down and talk to an agent and that is a smart decision Insurance agents are trained to spot inefficiencies and help you file claims. One of the great benefits of comparing rate quotes online is the fact that you can find the lowest rates and still choose a local agent.

To help locate an agent, after submitting this quick form, your information gets sent to local insurance agents that can give you free Columbus auto insurance quotes for your business. It's much easier because you don't need to search for any insurance agencies because quoted prices will be sent directly to your email. If you want to quote rates for a specific company, feel free to navigate to their website to submit a rate quote request.

To help locate an agent, after submitting this quick form, your information gets sent to local insurance agents that can give you free Columbus auto insurance quotes for your business. It's much easier because you don't need to search for any insurance agencies because quoted prices will be sent directly to your email. If you want to quote rates for a specific company, feel free to navigate to their website to submit a rate quote request.

Selecting an company requires you to look at more than just a cheap quote. These are valid questions to ask:

- Does the company have a solid financial rating?

- Are they giving you every discount you deserve?

- Is the agency covered by Errors and Omissions coverage?

- Will the agent help in case of a claim?

- Do they make recommendations based only on price?

- Does the company use OEM repair parts?

If you are wanting to find a reliable insurance agent, you must know there are a couple different types of agencies and how they are slightly different. Car insurance agencies are categorized either independent agents or exclusive agents depending on their employer. Either one can sell and service car insurance coverage, but it is a good idea to know the difference between them since it could factor into which agent you choose.

Exclusive Insurance Agents

These agents have only one company to place business with and some examples include Farmers Insurance, Allstate, or State Farm. These agents are unable to provide prices from multiple companies so if the price isn't competitive there isn't much they can do. Exclusive insurance agents receive a lot of sales training on sales techniques and that can be a competitive advantage.

The following are Columbus exclusive agencies that can give you comparison quotes.

Scott Dawson - State Farm Insurance Agent

5871 Cleveland Ave - Columbus, OH 43231 - (614) 891-2886 - View Map

Gianna R Cone - State Farm Insurance Agent

1495 Morse Rd #100 - Columbus, OH 43229 - (614) 267-7865 - View Map

American Family Insurance - Patricia Dews

114 Norton Rd - Columbus, OH 43228 - (614) 878-9720 - View Map

Independent Agents

Agents of this type can quote rates with many companies and that allows them to write policies through many companies and potentially find a lower price. To move your coverage to a new company, your policy is moved internally without you having to go to a different agency. If you are comparing car insurance prices, you absolutely need to get some free quotes from several independent insurance agents to ensure the widest selection of prices.

Below are independent agents in Columbus willing to provide rate quotes.

All Ohio Insurance Agency Inc

180 Northwoods Blvd - Columbus, OH 43235 - (614) 825-0770 - View Map

Henderson Insurance Inc

3620 N High St #105 - Columbus, OH 43214 - (614) 884-0970 - View Map

Nationwide Insurance: Glenn R Williams

2930 N High St - Columbus, OH 43202 - (614) 268-3567 - View Map

After you get positive feedback to any questions you may have as well as an affordable premium quote, it's a good possibility that you have found an auto insurance agent that meets your needs to properly service your car insurance policy. But keep in mind you can cancel a policy at any point so never assume that you are permanently stuck with your new company for any length of time.