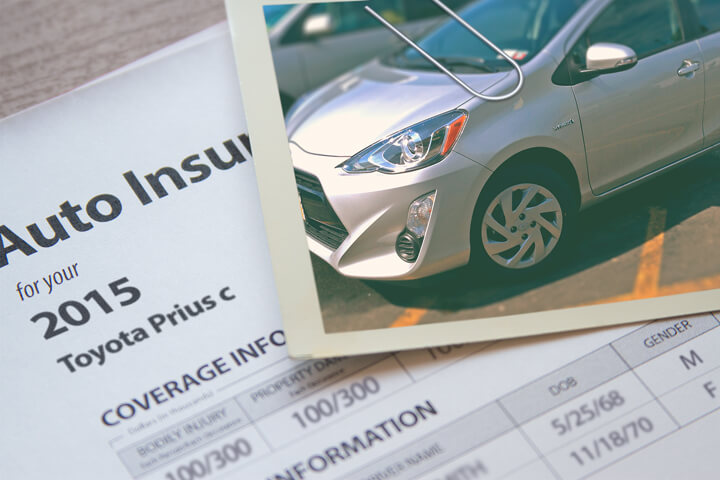

Toyota Prius insurance rates image courtesy of QuoteInspector.com

It's an obvious statement that car insurance companies don't want their customers to go rate shopping. Consumers who compare rates once a year are likely to switch to a new company because of the high probability of finding a policy with better rates. A survey found that consumers who routinely compared rates saved over $3,450 over four years as compared to drivers who never shopped around.

If finding discount rates on car insurance in Columbus is your ultimate goal, understanding how to compare coverages can save time and make the process easier.

It takes a few minutes, but the best way to find affordable quotes for Toyota Prius Prime insurance is to do a yearly price comparison from companies that sell auto insurance in Columbus.

It takes a few minutes, but the best way to find affordable quotes for Toyota Prius Prime insurance is to do a yearly price comparison from companies that sell auto insurance in Columbus.

First, get a basic knowledge of coverages and the steps you can take to keep rates low. Many rating criteria that drive up the price such as speeding tickets, careless driving and poor credit rating can be eliminated by paying attention to minor details.

Second, compare prices from direct carriers, independent agents, and exclusive agents. Exclusive agents and direct companies can only give prices from a single company like Progressive and State Farm, while independent agents can quote prices for a wide range of insurance providers. Compare rates now

Third, compare the price quotes to your existing rates to see if cheaper Prius Prime coverage is available in Columbus. If you find a lower rate, make sure coverage is continuous and does not lapse.

Fourth, notify your current company of your intent to cancel your current policy and submit payment along with a signed and completed policy application to the new company. Once received, keep the new certificate verifying proof of insurance along with the vehicle's registration papers.

The key aspect of shopping around is that you'll want to make sure you compare similar coverage information on each quote and and to compare all possible companies. This helps ensure a fair rate comparison and a complete selection of prices.

If you have insurance now or just want a better rate, you can follow these tips to find the best rates while maximizing coverage. Locating the most cost-effective auto insurance policy in Columbus can initially seem challenging. Smart buyers just need to know the least time-consuming way to compare prices from many different companies online.

Get cheaper Toyota Prius Prime insurance in Columbus with discounts

Companies that sell car insurance do not advertise their entire list of discounts in an easy-to-find place, so we researched some of the best known and the harder-to-find discounts that you can inquire about if you buy Columbus car insurance online.

- Waiver for an Accident - Not really a discount, but companies like Allstate and Progressive allow you one accident without the usual rate increase as long as you don't have any claims for a set time period.

- Seat Belts Save more than Lives - Requiring all passengers to use their safety belts can save a little off the medical payments premium.

- Good Drivers - Drivers without accidents can pay as much as 50% less than drivers with accident claims.

- Own a Home - Just being a homeowner can save you money because it demonstrates responsibility.

- Passive Restraint Discount - Factory air bags could see savings of 20 to 30 percent.

- Payment Method - By paying your entire bill at once as opposed to paying monthly you could save 5% or more.

Don't be shocked that most discount credits are not given to all coverage premiums. A few only apply to the cost of specific coverages such as liability, collision or medical payments. So despite the fact that it appears all the discounts add up to a free policy, car insurance companies aren't that generous.

Companies and their offered discounts are included below.

- Farm Bureau has savings for 55 and retired, youthful driver, multi-vehicle, multi-policy, safe driver, driver training, and renewal discount.

- MetLife may include discounts for accident-free, claim-free, good driver, good student, defensive driver, multi-policy

- Progressive includes discounts for continuous coverage, multi-policy, homeowner, online quote discount, and good student.

- AAA has discounts for anti-theft, education and occupation, pay-in-full, multi-policy, good student, and AAA membership discount.

- American Family discounts include defensive driver, good student, Steer into Savings, multi-vehicle, accident-free, early bird, and mySafetyValet.

- GEICO offers discounts for military active duty, multi-policy, seat belt use, good student, and federal employee.

- State Farm offers premium reductions for multiple policy, good driver, safe vehicle, accident-free, and multiple autos.

When getting free Columbus car insurance quotes, it's a good idea to every insurance company to apply every possible discount. A few discounts might not be offered on policies in your area. To find providers that offer some of these discounts in Columbus, click this link.

Finding cheap Toyota Prius Prime car insurance quotes can be relatively painless. All you need to do is spend a little time getting comparison quotes to find out which insurance company has low cost Columbus car insurance quotes.

Getting free price quotes online is quite simple, and it makes it obsolete to waste gas driving to and from local Columbus insurance agencies. Comparing online rate quotes has made agencies unnecessary unless you require the peace of mind that you can only get from talking to an agent. Although, it is possible get prices online but still have the advice of a local agent.

The companies in the list below provide price comparisons in Ohio. If more than one company is shown, we recommend you visit as many as you can to get a more complete price comparison.

Insurance is available from your local insurance agencies

A lot of people just prefer to buy from a licensed agent and that is just fine! Good insurance agents are trained to spot inefficiencies and will help you if you have claims. One of the great benefits of getting online price quotes is that you can find cheap rate quotes and still choose a local agent. And supporting neighborhood agents is especially important in Columbus.

To help locate an agent, after submitting this quick form, your insurance coverage information is transmitted to insurance agents in Columbus who can give free rate quotes for your business. There is no need to do any legwork because quoted prices will be sent to your email. If for some reason you want to get a price quote from a specific insurance company, just visit that company's website and complete a quote there.

To help locate an agent, after submitting this quick form, your insurance coverage information is transmitted to insurance agents in Columbus who can give free rate quotes for your business. There is no need to do any legwork because quoted prices will be sent to your email. If for some reason you want to get a price quote from a specific insurance company, just visit that company's website and complete a quote there.

If you're trying to find a reputable agency, it can be helpful to understand the types of insurance agents to choose from. Insurance agents in Columbus may be either exclusive or independent (non-exclusive). Either type can write policy coverage, but it's important to point out the differences since it can impact the selection process.

Independent Insurance Agencies

Independent agents are not employed by one company so they can quote policies with lots of companies and get you the best rates possible. To transfer your coverage to a different company, an independent agent can move your coverage and you don't have to do anything. If you are comparing rate quotes, you definitely need to compare prices from multiple independent agents in order to have the best price comparison.

Featured below are independent agents in Columbus who can help you get cheap rate quotes.

Franchise Insurance Agency, Inc.

4930 Reed Rd Suite 100 - Columbus, OH 43220 - (614) 451-2232 - View Map

Augustine Insurance Agency

3851 N High St - Columbus, OH 43214 - (614) 267-1973 - View Map

Tri-Wood Insurance

1000 Georgesville Rd - Columbus, OH 43228 - (614) 276-7821 - View Map

Exclusive Insurance Agents

Agents in the exclusive channel work for only one company such as Farmers Insurance or State Farm. These agents are not able to place coverage with different providers so if the price isn't competitive there isn't much they can do. Exclusive insurance agents are very knowledgeable in insurance sales which helps them sell insurance even at higher premiums.

Listed below is a short list of exclusive agents in Columbus willing to provide rate quotes.

Vic Jimenez - State Farm Insurance Agent

35 N Wilson Rd - Columbus, OH 43204 - (614) 272-5456 - View Map

Amie Kim - State Farm Insurance Agent

1246 N High St - Columbus, OH 43201 - (614) 586-8701 - View Map

Buddy White - State Farm Insurance Agent

1500 S Hamilton Rd - Columbus, OH 43227 - (614) 864-1050 - View Map

Finding the right insurance agent requires more thought than just a cheap price. Before buying a policy in Columbus, get answers to these questions.

- Are they properly licensed to sell insurance in Ohio?

- Do they assist clients in filing claims?

- How often do they review policy coverages?

- Are claims handled at the agent's location?

- Do the coverages you're quoting properly cover your vehicle?

- Can they provide you with a list of referrals?

- Will your rates increase after a single accident?

- If they are an independent agency in Columbus, which companies do they recommend?

Upon getting good responses to your questions as well as a price you're happy with, it's possible that you found a car insurance agent that can be trusted to properly service your insurance policy.

Quote more and you will save more

As you restructure your insurance plan, make sure you don't skimp on critical coverages to save a buck or two. There are many occasions where an insured cut comprehensive coverage or liability limits and discovered at claim time that saving that couple of dollars actually costed them tens of thousands. Your aim should be to buy a smart amount of coverage at the lowest possible cost and still be able to protect your assets.

Budget-friendly car insurance in Columbus is available both online in addition to local insurance agencies, so you should be comparing quotes from both to have the best chance of lowering rates. Some insurance companies don't offer internet price quotes and many times these regional insurance providers provide coverage only through local independent agencies.

To read more, feel free to visit the following helpful articles:

- What is a Telematics Device? (Allstate)

- Who Has Cheap Auto Insurance for a Nissan Altima in Columbus? (FAQ)

- Who Has Affordable Columbus Auto Insurance for Handicapped Drivers? (FAQ)

- Who Has Affordable Columbus Auto Insurance for a GMC Sierra? (FAQ)

- How Much Auto Coverage do I Need? (Insurance Information Institute)

- What is Covered by GAP Insurance? (Allstate)