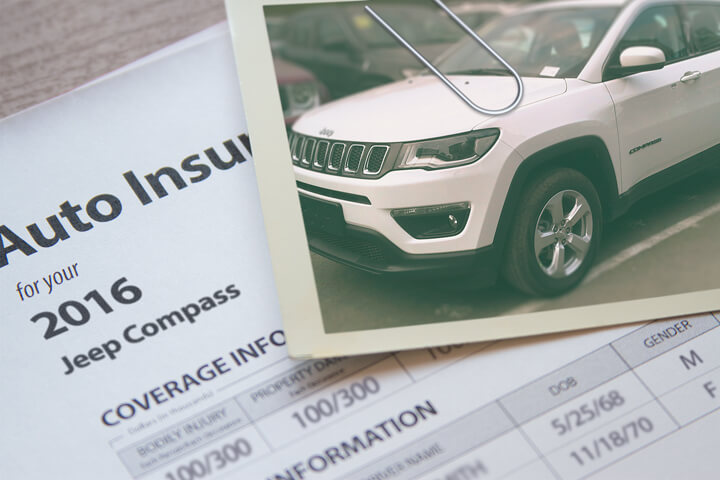

Jeep Compass insurance image courtesy of QuoteInspector.com

Car insurance shoppers not familiar with comparing quotes online might discover locating the cheapest Jeep Compass insurance in Columbus is more work than they anticipated.

Steps to finding cheaper rates for Jeep Compass insurance in Columbus

Really, the only way to get budget Jeep Compass insurance is to start doing an annual price comparison from providers in Columbus. Rate comparisons can be done by completing these steps.

- Get a basic knowledge of what coverages are included in your policy and the steps you can take to prevent high rates. Many rating factors that increase rates such as high-risk driving behaviors and an unfavorable credit rating can be rectified by making small lifestyle or driving habit changes.

- Compare rates from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only give prices from a single company like GEICO or Farmers Insurance, while independent agencies can quote prices for a wide range of companies. Start a quote

- Compare the new quotes to your existing rates and determine if cheaper Compass coverage is available in Columbus. If you can save money and change companies, ensure there is no coverage lapse between policies.

- Tell your current agent or company of your intent to cancel your current auto insurance policy and submit payment along with a signed and completed policy application to your new carrier. Once received, place the new certificate verifying coverage in a readily accessible location in your vehicle.

The critical component of shopping around is to make sure you're comparing the same level of coverage on every price quote and and to get quotes from as many companies as you can. Doing this ensures the most accurate price comparison and maximum price selection.

It's a fact that auto insurance companies don't want you to look at other companies. Insureds who shop around are likely to buy a new policy because there are good odds of finding a lower-cost company. A survey found that drivers who faithfully checked for cheaper rates saved as much as $3,400 over four years as compared to drivers who never shopped for cheaper rates.

It's a fact that auto insurance companies don't want you to look at other companies. Insureds who shop around are likely to buy a new policy because there are good odds of finding a lower-cost company. A survey found that drivers who faithfully checked for cheaper rates saved as much as $3,400 over four years as compared to drivers who never shopped for cheaper rates.

If finding budget-friendly auto insurance in Columbus is your ultimate goal, then having some insight into the best way to shop and compare car insurance can make the process less intimidating.

You need to do rate comparisons before your next renewal because prices are constantly changing. Even if you think you had the lowest price on Jeep Compass insurance in Columbus on your last policy there is a good chance you can find better rate quotes now. Forget anything you know (or think you know) about insurance because you're about to find out the fastest and easiest way to properly buy coverages while reducing your premium.

Obtaining price quotes for the most affordable policy in Columbus is not as hard as you may think. Basically, everyone who is looking for a better price on auto insurance will find a lower-cost policy. But Ohio car owners benefit from understanding the way companies price online insurance and use this information to your advantage.

When comparison shopping, there are several ways to compare rate quotes from companies that offer auto insurance in Ohio. The easiest way by far to find cheaper Jeep Compass rates is to use the internet to compare rates.

Just remember that having more price comparisons helps you find a better price. Not every company allows you to get price estimates online, so you also need to get quotes from them as well.

The companies shown below can provide free rate quotes in Ohio. If several companies are displayed, it's a good idea that you visit two to three different companies in order to find the most affordable rates.

Coverage statistics and figures

The rate table shown below covers a range of insurance costs for Jeep Compass models. Having a better understanding of how premiums are calculated is important for making smart choices when selecting a coverage provider.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Compass Sport 2WD | $140 | $224 | $234 | $14 | $70 | $682 | $57 |

| Compass Sport 4WD | $160 | $272 | $234 | $14 | $70 | $750 | $63 |

| Compass Limited 2WD | $160 | $272 | $234 | $14 | $70 | $750 | $63 |

| Compass Limited 4WD | $160 | $272 | $234 | $14 | $70 | $750 | $63 |

| Get Your Own Custom Quote Go | |||||||

Above prices assume married male driver age 40, no speeding tickets, no at-fault accidents, $250 deductibles, and Ohio minimum liability limits. Discounts applied include safe-driver, multi-policy, multi-vehicle, claim-free, and homeowner. Price information does not factor in zip code location which can change premium rates noticeably.

Impact of violations and accidents on rates

The illustration below highlights how traffic violations and at-fault claims impact Jeep Compass premium costs for each age group. Data assumes a single male driver, full coverage, $250 deductibles, and no policy discounts are applied.

Local Columbus insurance agents

A lot of people would rather get professional advice from a licensed agent and doing so can bring peace of mind The best thing about comparing car insurance online is that you can obtain cheaper prices and still buy from a local agent. And providing support for small agencies is especially important in Columbus.

For easy comparison, once you complete this form (opens in new window), the coverage information is transmitted to agents in your area who will give competitive quotes and help you find cheaper coverage. It simplifies rate comparisons since you won't have to leave your house due to the fact that quote results will go to you instantly. You can get cheaper car insurance rates and an insurance agent to talk to. If you have a need to get a rate quote for a specific company, just visit that company's website and fill out their quote form.

For easy comparison, once you complete this form (opens in new window), the coverage information is transmitted to agents in your area who will give competitive quotes and help you find cheaper coverage. It simplifies rate comparisons since you won't have to leave your house due to the fact that quote results will go to you instantly. You can get cheaper car insurance rates and an insurance agent to talk to. If you have a need to get a rate quote for a specific company, just visit that company's website and fill out their quote form.

If you need to find a good Columbus insurance agent, there are two different agency structures and how they can quote your rates. Insurance agencies in Columbus are categorized either exclusive agents or independent agents.

Independent Insurance Agents

Independent insurance agents are not employed by one company and that is an advantage because they can write policies with lots of companies enabling the ability to shop coverage around. If they quote lower rates, the business is moved internally and you don't have to do anything. When comparing car insurance rates, you need to compare quotes from several independent insurance agents to get the best comparison. Most also have access to smaller companies which may have better rates.

Shown below are Columbus independent insurance agencies that may be able to give you price quotes.

- Nationwide Insurance - Nick Miller and Assoc Ins Agency Inc

6834 Caine Rd - Columbus, OH 43235 - (614) 889-0701 - View Map - Tri-Wood Insurance

1000 Georgesville Rd - Columbus, OH 43228 - (614) 276-7821 - View Map - All Ohio Insurance Agency Inc

180 Northwoods Blvd - Columbus, OH 43235 - (614) 825-0770 - View Map

Exclusive Car Insurance Agents

Agents that choose to be exclusive can only write with one company like AAA, State Farm, Farmers Insurance, and Allstate. These agents are not able to provide other company's prices so it's a take it or leave it situation. Exclusive agencies are usually well trained on their company's products which helps them compete with independent agents. Consumers often buy insurance from these agents partially due to the brand rather than low price.

Below is a list of exclusive agents in Columbus that can give you rate quotes.

- Gianna R Cone - State Farm Insurance Agent

1495 Morse Rd #100 - Columbus, OH 43229 - (614) 267-7865 - View Map - Bruce Rothermund - State Farm Insurance Agent

50 Northwoods Blvd - Columbus, OH 43235 - (614) 888-5830 - View Map - Jonathan Yu - State Farm Insurance Agent

1930 Crown Park Ct #140 - Columbus, OH 43235 - (614) 885-9507 - View Map

Choosing the best car insurance agent needs to be determined by more than just a cheap quote. These are some questions you should get answers to.

- If you are a high risk driver, do they have special markets for your coverage?

- Are they actively involved in the community?

- Does the agency have a good rating with the Better Business Bureau?

- How long has their agency been open in Columbus?

- Will you work with the agent or an assistant?