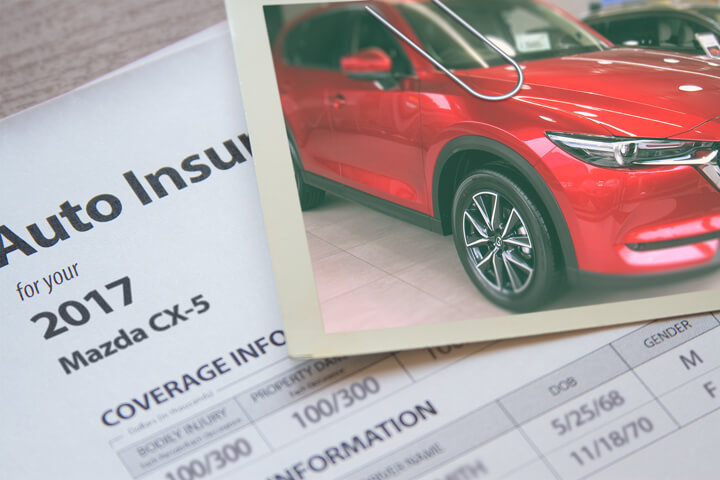

Mazda CX-5 insurance image courtesy of QuoteInspector.com

It's well known that insurance companies want to keep you from comparing prices. Insureds who shop around for better prices will presumably move their business because there is a good probability of finding a lower-cost company. A recent survey discovered that drivers who compared prices regularly saved as much as $3,450 over four years compared to those who never compared rates.

If finding budget-friendly Mazda CX-5 insurance in Columbus is your intention, then learning about how to compare insurance premiums can help you be more efficient.

If you want to save money, the best way to find more affordable Mazda CX-5 insurance is to do a yearly price comparison from insurance carriers who provide car insurance in Columbus. You can shop around by following these guidelines.

If you want to save money, the best way to find more affordable Mazda CX-5 insurance is to do a yearly price comparison from insurance carriers who provide car insurance in Columbus. You can shop around by following these guidelines.

- First, read and learn about how car insurance works and the measures you can take to prevent rate increases. Many rating criteria that drive up the price like at-fault accidents and a negative credit score can be remedied by making minor driving habit or lifestyle changes. Keep reading for tips to get cheaper rates and get bigger discounts that may have been overlooked.

- Second, compare price quotes from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can only provide price estimates from a single company like Progressive or State Farm, while independent agencies can provide price quotes from multiple insurance companies.

- Third, compare the price quotes to your existing coverage to see if you can save by switching companies. If you find a better price and change companies, ensure there is no coverage lapse between policies.

- Fourth, provide notification to your current company to cancel your current coverage. Submit a down payment along with a signed application for the new coverage. Make sure you keep your new certificate verifying proof of insurance in a readily accessible location in your vehicle.

An important bit of advice to remember is to try to compare identical limits and deductibles on each price quote and and to look at as many car insurance companies as possible. This guarantees an apples-to-apples comparison and the best rate selection.

If you already have coverage or are shopping for new coverage, use these techniques to reduce premiums without reducing protection. Locating the best insurance company for you in Columbus can be made easier if you know where to look. Shoppers just have to learn the quickest way to get comparison quotes using one simple form.

The easiest way to compare rate quotes for Mazda CX-5 insurance in Columbus takes advantage of the fact most of the larger companies provide online access to give free rates quotes. To start a quote, the only thing you need to do is provide details like how much education you have, if you have a valid license, if you require a SR-22, and how many miles driven. The rating information is then submitted to all major companies and they return rate quotes immediately.

To check Mazda CX-5 insurance prices now, click here and enter the information requested.

The following companies are ready to provide quotes in Ohio. If multiple companies are listed, we suggest you compare several of them in order to get a fair rate comparison.

Insurance agents near you

A lot of people just want to get advice from a local agent and that is a smart decision Insurance agents will help you protect your assets and help file insurance claims. The best thing about comparing auto insurance online is that you can obtain the lowest rates and still have a local agent. Putting coverage with neighborhood insurance agencies is important particularly in Columbus.

To make it easy to find an agent, after completing this short form, your coverage information gets sent to local insurance agents who will gladly provide quotes for your auto insurance coverage. There is no reason to find an agent on your own as quotes are delivered immediately to your email address. In the event you want to quote rates from a specific auto insurance provider, just go to their quote page and give them your coverage information.

Two types of Columbus car insurance agents

If you're trying to find a good Columbus insurance agent, you must know there are a couple different types of agencies and how they are distinctly different. Insurance agencies in Columbus can be categorized as either independent agents or exclusive agents. Either one can do a good job, but it's good to learn how they differ since it may influence buying decisions.

Independent Auto Insurance Agents (or Brokers)

These type of agents can quote rates with many companies so they can quote policies with any number of different companies depending on which coverage is best. To transfer your coverage to a different company, they simply switch companies in-house which makes it simple for you.

If you need cheaper auto insurance rates, you need to include price quotes from several independent insurance agents so that you have a good selection of quotes to compare.

Below is a small list of independent insurance agencies in Columbus who may provide price quote information.

W.E. Davis Insurance Agency

29 Frederick St - Columbus, OH 43206 - (614) 443-0533 - View Map

Gardiner Allen DeRoberts Insurance LLC

777 Goodale Blvd - Columbus, OH 43212 - (614) 221-1500 - View Map

Augustine Insurance Agency

3851 N High St - Columbus, OH 43214 - (614) 267-1973 - View Map

Exclusive Auto Insurance Agencies

Agents in the exclusive channel have only one company to place business with like Allstate, Farmers Insurance or State Farm. Exclusive agents cannot give you multiple price quotes so they really need to provide good service. These agents receive extensive training on sales techniques which can be an advantage.

Below are exclusive insurance agencies in Columbus that can give you price quote information.

Ray Cook - State Farm Insurance Agent

7846 Olentangy River Rd - Columbus, OH 43235 - (614) 846-2886 - View Map

American Family Insurance - Felix Quachey

1100 Morse Rd Ste 301 - Columbus, OH 43229 - (614) 536-0237 - View Map

Buddy White - State Farm Insurance Agent

1500 S Hamilton Rd - Columbus, OH 43227 - (614) 864-1050 - View Map

Choosing the best insurance agent is decision based upon more than just a low price. These are some questions you should get answers to.

- Are they in the agency full-time?

- Do you work with a CSR or direct with the agent?

- Can glass repairs be made at your home?

- Which family members are covered?

- Is the agency involved in supporting local community causes?

- Does the agent help file claims?

- Do they have advanced training designations such as CPCU, AAI, AIC, or CIC?

- Do they receive special compensation for putting your coverage with one company over another?