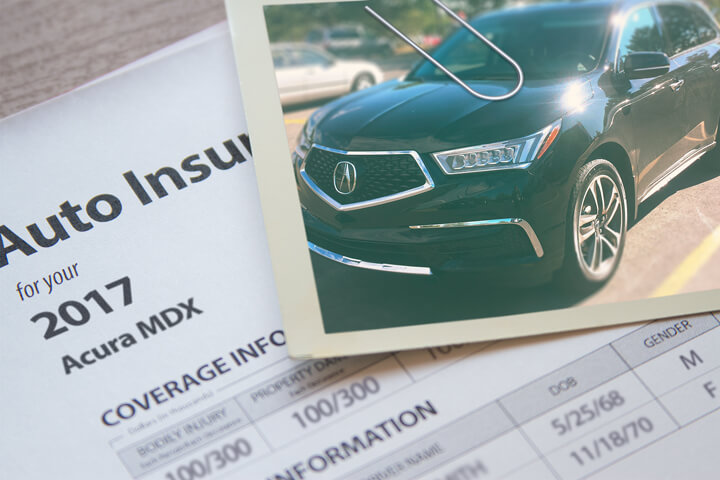

Acura MDX insurance image courtesy of QuoteInspector.com

Shockingly, most consumers kept their coverage with the same insurance company for a minimum of four years, and approximately 38% of consumers have never compared insurance rates at all. Many drivers in Columbus could save an average of approximately 55% each year by just comparing quotes, but they just don't want to shop their coverage around.

Shockingly, most consumers kept their coverage with the same insurance company for a minimum of four years, and approximately 38% of consumers have never compared insurance rates at all. Many drivers in Columbus could save an average of approximately 55% each year by just comparing quotes, but they just don't want to shop their coverage around.

The most effective way to find the cheapest price for auto insurance rates in Columbus is to compare prices regularly from companies that sell auto insurance in Ohio.

- First, get an understanding of what coverages are included in your policy and the modifications you can make to drop your rates. Many factors that result in higher rates such as traffic violations, accidents, and poor credit history can be amended by making minor changes to your lifestyle.

- Second, obtain price quotes from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only give rate quotes from a single company like GEICO or Allstate, while agents who are independent can provide prices for a wide range of companies.

- Third, compare the quotes to your existing policy to see if switching to a new carrier will save money. If you find a lower rate quote and make a switch, verify that coverage does not lapse between policies.

- Fourth, notify your company or agent of your decision to cancel the current policy. Submit payment and a signed application to your new agent or company. As soon as coverage is bound, place your new certificate verifying coverage in a readily accessible location in your vehicle.

The critical component of shopping around is to make sure you're comparing the same coverage limits and deductibles on every price quote and and to get rates from as many companies as possible. This helps ensure a level playing field and a complete price analysis.

If you have a current auto insurance policy, you will be able to find better prices using the ideas presented in this article. Choosing the best rates in Columbus is really quite simple as long as you have a good starting point. But Ohio vehicle owners do need to learn how companies calculate your policy premium and use it to your advantage.

The quickest method we recommend to compare rates for Acura MDX insurance in Columbus takes advantage of the fact auto insurance companies will pay a fee to provide you with a free rate quote. The one thing you need to do is provide the companies a bit of rating information like deductibles desired, if a SR-22 is required, your occupation, and types of safety features. That information is instantly submitted to many highly-rated insurers and you receive quotes immediately.

To find lower cheaper Acura MDX insurance rates now, click here and enter your zip code.

The providers in the list below provide price quotes in Ohio. If the list has multiple companies, it's highly recommended you compare several of them to find the lowest auto insurance rates.

Acura MDX insurance analysis

The rate table shown next showcases detailed analysis of insurance prices for Acura MDX models. Being more informed about how insurance premiums are calculated can help you make informed coverage decisions.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| MDX 4WD | $212 | $364 | $256 | $16 | $76 | $924 | $77 |

| MDX with Tech Package 4WD | $212 | $428 | $256 | $16 | $76 | $988 | $82 |

| MDX with Tech/Entertainment 4WD | $212 | $428 | $256 | $16 | $76 | $988 | $82 |

| MDX Advance 4WD | $212 | $428 | $256 | $16 | $76 | $988 | $82 |

| MDX Advance/Entertainment 4WD | $212 | $428 | $256 | $16 | $76 | $988 | $82 |

| Get Your Own Custom Quote Go | |||||||

Table data assumes single male driver age 50, no speeding tickets, no at-fault accidents, $100 deductibles, and Ohio minimum liability limits. Discounts applied include safe-driver, multi-vehicle, homeowner, multi-policy, and claim-free. Price information does not factor in specific zip code location which can lower or raise premiums significantly.

Physical damage deductible comparison

One of the hardest decisions when shopping for car insurance is the level to set your comp and collision deductibles. The tables below approximate the cost difference of buying low and high physical damage deductibles. The first data table uses a $100 deductible for comp and collision and the second pricing table uses a $1,000 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| MDX 4WD | $246 | $352 | $226 | $14 | $68 | $931 | $78 |

| MDX with Tech Package 4WD | $246 | $416 | $226 | $14 | $68 | $995 | $83 |

| MDX with Tech/Entertainment 4WD | $246 | $416 | $226 | $14 | $68 | $995 | $83 |

| MDX Advance 4WD | $246 | $416 | $226 | $14 | $68 | $995 | $83 |

| MDX Advance/Entertainment 4WD | $246 | $416 | $226 | $14 | $68 | $995 | $83 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| MDX 4WD | $136 | $186 | $226 | $14 | $68 | $630 | $53 |

| MDX with Tech Package 4WD | $136 | $220 | $226 | $14 | $68 | $664 | $55 |

| MDX with Tech/Entertainment 4WD | $136 | $220 | $226 | $14 | $68 | $664 | $55 |

| MDX Advance 4WD | $136 | $220 | $226 | $14 | $68 | $664 | $55 |

| MDX Advance/Entertainment 4WD | $136 | $220 | $226 | $14 | $68 | $664 | $55 |

| Get Your Own Custom Quote Go | |||||||

Data based on married male driver age 30, no speeding tickets, no at-fault accidents, and Ohio minimum liability limits. Discounts applied include safe-driver, multi-policy, multi-vehicle, claim-free, and homeowner. Prices do not factor in vehicle location which can decrease or increase price quotes noticeably.

Using the premium rates above, we can conclude that using a $100 deductible costs roughly $27 more each month or $324 every year than quoting the higher $1,000 deductible. Because you would pay $900 more out-of-pocket with a $1,000 deductible as compared to a $100 deductible, if you go at a minimum 33 months between claim filings, you would come out ahead by going with a higher deductible.

The information below illustrates how your choice of deductibles and can impact Acura MDX insurance costs for each age group. The premiums are based on a married female driver, full physical damage coverage, and no discounts are applied to the premium.

Neighborhood agents and insurance

Many drivers just want to buy from a local agent and that is OK! One of the great benefits of comparing insurance online is that you can find cheaper prices but also keep your business local.

To find an agent, once you fill out this simple form, the coverage information is emailed to agents in your area who can give free rate quotes to get your business. You don't have to contact any insurance agencies as quotes are delivered instantly to you. It's the lowest rates AND a local agent. In the event you want to get a price quote for a specific company, feel free to navigate to their website and complete a quote there.

To find an agent, once you fill out this simple form, the coverage information is emailed to agents in your area who can give free rate quotes to get your business. You don't have to contact any insurance agencies as quotes are delivered instantly to you. It's the lowest rates AND a local agent. In the event you want to get a price quote for a specific company, feel free to navigate to their website and complete a quote there.

Finding a good insurer should depend on more than just a cheap price quote. The following questions are important to ask.

- Is assistance available after office hours?

- Do they specialize in personal lines auto insurance in Columbus?

- Is the agency active in community causes in Columbus?

- Are they full-time agents?

- If you raise deductibles, how much can you save?

- Will they give you a referral list?

Independent or Exclusive: It's your choice

When finding a local agent, it's helpful to know the different agency structures to choose from. Agencies in Columbus are considered either independent agents or exclusive agents.

Exclusive Agencies

Agents of this type have only one company to place business with and some examples include Allstate, AAA, Farmers Insurance, and State Farm. Exclusive agencies are unable to provide other company's prices so keep that in mind. Exclusive insurance agents are trained well on their company's products which aids in selling service over price.

Listed below is a list of exclusive insurance agencies in Columbus who may provide you with price quotes.

Russell A Popp - State Farm Insurance Agent

2844 Johnstown Rd - Columbus, OH 43219 - (614) 471-5557 - View Map

Danny Hilton - State Farm Insurance Agent

3276 Morse Rd b - Columbus, OH 43231 - (614) 475-8808 - View Map

Nikki Ogunduyile - State Farm Insurance Agent

20 S 3rd St #210 - Columbus, OH 43215 - (614) 274-7130 - View Map

Independent Agents

Independent agents are not employed by any specific company and that allows them to write policies with an assortment of companies and help determine which has the cheapest rates. If they quote lower rates, your agent can switch companies which requires no work on your part.

If you need lower rates, we recommend you get rate quotes from several independent agencies to have the most options to choose from.

Shown below is a list of independent agencies in Columbus that are able to give price quotes.

Wiles Insurance Agency

348 Granville St - Gahanna, OH 43230 - (614) 536-0370 - View Map

All Ohio Insurance Agency Inc

180 Northwoods Blvd - Columbus, OH 43235 - (614) 825-0770 - View Map

John Dawson Associates

6025 Cleveland Ave - Columbus, OH 43231 - (614) 890-1660 - View Map

Once you have received acceptable answers for all questions you ask as well as cheaper MDX insurance quotes, it's a good possibility that you have found an insurance agency that meets the criteria to properly service your insurance policy.